You Lose Nothing with High Inflation. Stop Worrying

See how high inflation really works

We are all getting richer. Inflation is not news to anyone.

Newspapers just write headlines that destroy people’s mental health:

“The next financial crisis is already on its way.”

“The time of the fat cows is over”.

“Inflation is ruining your life”.

They make us believe that we are all doomed.

Fear and panic never got anyone anywhere. So let’s take a deep breath and look at some data about high inflation.

A high inflation rate is nothing new either. Throughout history, there have always been phases of price increases.

Over the past few years, inflation has been quite low. This is why we are not used to it and were shocked at first when the media started gossiping, which of course is the only way for them to gain more audience and money.

Even the worst ice cream parlor where you live can raise prices if a large number of people are willing to pay the higher price.

Things get more expensive when there is a lot of money circulating and few things on the market.

If everyone wants a Tesla and there is little production, prices will inevitably go up because everyone wants one.

Inflation is good

We are getting richer.

Since the economic crisis of the 1930s, there have been very few years when prices have fallen on average.

Maybe you are thinking:

Probably we shouldn’t keep getting poorer if prices keep going up.

The answer is no.

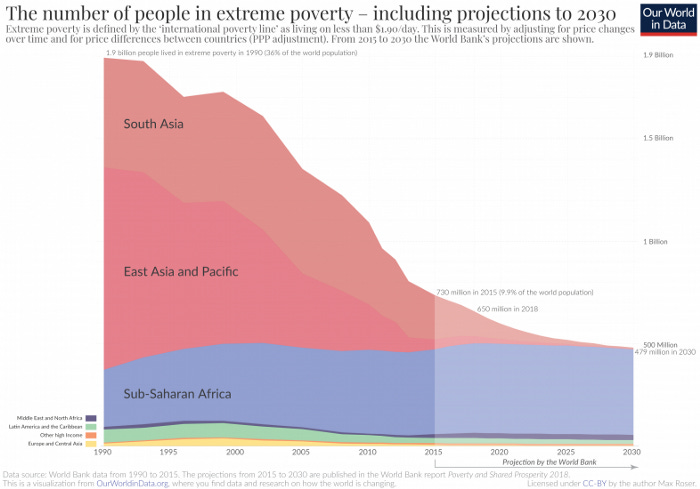

Extreme poverty has decreased dramatically in recent years and will probably no longer exist in the near future.

If prices rise, people are more likely to invest or spend their money. This stimulates the economy.

After all, they don’t want to run the risk of having to pay more for the new purchase later.

Even with all the signs pointing to a price increase, the small investor still wants to be there as soon as possible to reap good returns.

Unlike in the 1990s, today we work less to buy many things. Because wages have increased disproportionately to the rate of inflation.

In 1991 you would have to work more than 50 hours to be able to buy a washing machine. But today with 20 hours less you are well off.

High inflation is also good for those with mortgage debt. Especially if the interest rate has been fixed for a long time. Since the loan amount is selected, the value of the money decreases.

This does not apply to short-term loans, such as overdrafts, where the interest rates are adjusted for inflation.

You shouldn’t worry about high inflation because the adjustment of inflation, wages, and interest rates doesn’t happen all at once. It always takes a while for these processes to take hold.

Only when inflation is the villain

Inflation is the worst thing in the world for those who let their money rot in their checking account.

Or for those whose salaries cannot keep up with the rate of inflation.

Inflation hits those who spend more than they earn.

If I went to the bank for a loan to buy a house and a car, the sudden price increases for fuel and heating oil are undoubtedly a big problem.

At the end of the day, as inflation increases, the salaries of wage earners increase, and those who work in commerce also increase. On top of this, houses become more valuable, and the number of millionaires increases.

The stock market in times of high inflation

Stocks in public companies have far outperformed inflation over the past 100 years.

But real estate and gold have been left behind.

Even so, stocks are not good protection against high inflation in the short and medium term, but rather in withstanding these fluctuations and seeing your money grow in the long term.

You can only earn compound interest if you are willing to lose a tooth on something and not let the dips take you off the road.

If your expenses are less than your income and you invest the rest in the long term, congratulations, you have built great protection against high inflation.

Not everyone can do this.

Did you like this post? Press the “heart” button, please! Comment, screenshot, and share! Forward it to a friend! Every little bit helps build a better money culture.