Your House Doesn’t Help You Create Wealth. Your House Only Helps Governments Make More Money

Look around where you live

Friends,

There is no doubt that governments are the ones who benefit most from high inflation. Because the higher the inflation the more the public debt is reduced.

As a homeowner, high inflation can also reduce your mortgage debt.

Owning a house is expensive.

If you think that to own a house it is enough to have a mortgage, try to have one.

Here are some of the annual costs that you will need to budget for as part of your housing costs.

Mortgage.

Mortgage insurance.

Property taxes.

Necessary maintenance (such as replacing shingles on the roof or fixing a broken pipe)

Renovations and upgrades.

Homeowners’ association (HOA) or condominium fees

Utility bills.

Homeowners insurance.

If you want to sell your home, it is expensive and time-consuming.

The time and cost required to sell a home will make you rethink your decision.

From a long-term wealth accumulation perspective, a house can be both positive and negative.

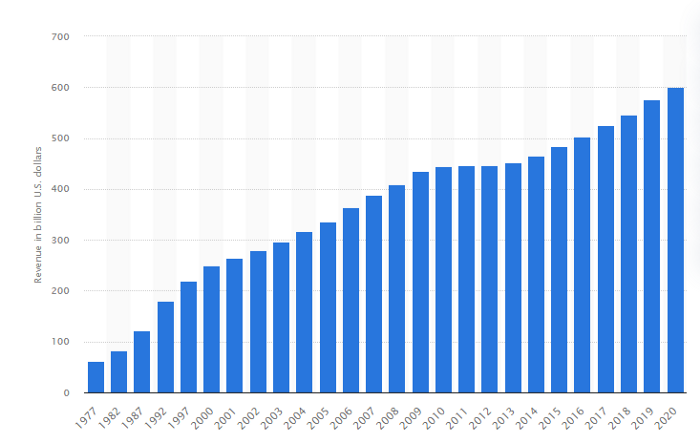

In 2020 alone, state and local governments in the United States collected about $599.99 billion through property taxes.

Without the increase in house prices, the US would be in a not-so-good financial situation. These numbers show how much the state is benefiting from the housing market.

Since 2009, the beginning of the real estate boom in the USA, the state has collected a total of 2 trillion dollars by the end of 2020.

Of course, property tax and property transfer tax revenue have increased, but payroll and business taxes in the construction industry are also yielding significantly more money today.

These taxes can clearly be attributed to the construction industry and to home buyers and owners. Basically, the taxes that brokers and notaries pay are because they also earn a lot from rising prices.

Likewise, the higher taxes that landlords pay because of higher rental income, but are hard to isolate. If you add it all up, you can see the state as a big beneficiary of the real estate boom.

It doesn’t matter whether you are selling land, a house, or an apartment: real estate transfer tax applies to all real estate transactions.

The real estate transfer tax is now one of the largest taxes in the US. Revenues continue to rise, but not because the number of real estate transactions per year is increasing; these have recently stagnated.

All because real estate prices are rising and, with them, the percentage that goes to the state.

Since the beginning of the real estate boom, however, almost all countries have increased rates, some even nearly doubling. Thanks to the increase in sales and property prices, this triples the revenue.

The cause of the housing bubble is a crucial and unresolved question. Many economists have argued that easy credit was responsible for the housing disaster. Easy credit and low-interest rates make it easier for more people to buy houses, increasing demand and raising housing prices.

Governments stand to gain from your house.

The taxes that governments charge are absurd.

Houses should be free of taxes.

Food should be tax-free.

Governments should not charge taxes.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.